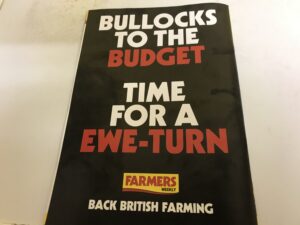

Rye is surrounded by countryside that consists of many farms run by the same families for decades. This has been put in jeopardy by the measures announced in the budget.

After forty years there will be a change to Agricultural Property Relief (APR) on inheritance tax from zero to 20%, on agricultural assets valued above £1m. The National Farmers’ Union (NFU) is disputing treasury claims that just 27% farms would be affected – mainly large estates.

Another department of the government, DEFRA has figures which show 66% of farms are valued over £1m. Farmers are asset rich but cash poor, the assets being land, farm houses, buildings, stock, crops and machinery- the tools to produce food.

Family farms are also keeping the countryside as we know it through environment schemes.

There are millionaires that have used agriculture as a way to avoid paying tax, but surely there must be a better way to close this loophole without jeopardising family farms.

Image Credits: Sue Winston CC .

Given that more than a third of children in the UK are now living in poverty according to a study by the Social Metrics Commission, is it really that unreasonable to apply a modest inheritance tax to the wealthiest land owners? I think not. As the author points out, millionaires (not to mention billionaires) are increasingly purchasing farming land to dodge tax, with ever less farming land being sold to real farmers. This in turn pushes land prices up, making it inaccessible to genuine farmers.

It’s no surprise at all to see fake millionaire farmers like Jeremy Clarkson making the biggest fuss, it is they who control much of the media too. I think the tax is clumsy, for sure, but there is no reason for farmers to dodge taxes when many in this country live in deprivation.

Stating that family farms are keeping the countryside as we know it is disingenuous. That’s very much a mixed bag. Agriculture is responsible for 66% of the UK’s nitrous oxide emissions and 46% of UK methane emissions, and largely to blame for our dead rivers, with no river in the UK achieving a high or good overall health status.

I would like to see a shift away from tax dodging mega farms towards farming collectives operated using regenerative, small scale, sustainable farming methods. That can only happen with the right incentives. I agree with the author that there needs to be a better way to support family farms, but they in turn need significant reform to meet the often conflicting pressures of today’s world.

So easy to blame farmers for all the worlds problems when your belly is full. You should be thanking farmers if you ate today or drank today, unless you live off water and tree leaves !

Food is actually cheap in the UK compared to most Countries of the World, so blaming farmers for child poverty is rather harsh to the point of ignorant. The Governments definition of poverty is :

”Households are considered to be below the UK poverty line if their income is below 60% of the median household income after housing costs for that year” ……….. which ironically probably accounts to most farming families.

No mention also in your comments that the Water Companies are discharging mega amounts of sewage and dirty water into the rivers and watercourses, but guess it’s easier to blame farmers; or that most methane is caused by natural wetlands, fossil fuels, decomposition of landfill waste, but it’s easier to blame cows and farming.

Only 4% of people pay inheritance tax. In my opinion it should be abolished as people have already paid tax on that money. This will also stop the wealthy from buying farmland. Inheritance tax on farmland will only result in more expensive food. Will you blame the farmers for that or realise it’s was actually the politicians fault ?

Yep, we can revert to collective farming as they did in the days of the Kulaks. That worked well didn’t it?

Dominic Manning’s comment about IHT on the wealthiest land owners completely misunderstands what the effects of the proposed new tax will have on farmers like ourselves who have farmed for over a century locally.

The assets of most farms in this area are significant without including the value of the land. For example an ordinary 150 horsepower tractor is well over £150k new, a beef cow which you have to keep for 3 years from birth before it produces a calf will be up to £2k, even a breeding sheep is worth £200. The problem is that the costs and the profitability of farms is very low. Many could turnover a million pounds, yet only have gross profits of under 10% to pay themselves and reinvest in the business.

The removal of the EU subsidy system and the move to environmental payments which will be lower, further reduces profitability and production. Planting trees will please Dominic, but we don’t eat them.

The total assets of an average farm locally including the land could be in excess of £5million. The tax liability would be over £600k. The only way to pay this off would be to sell off some of the assets, this would then decrease profitability and further reduce investment.

The Labour government manifesto to improve the economy was to encourage business to invest to increase production. Exactly the opposite will happen in farming which will have the effect of reducing output and increasing food prices.

There are ways of raising taxes from land sales. The removal or higher taxation of Roll over relief where anyone who sells land can avoid paying tax by buying more land. Some land that is sold to build houses on can be a million pounds an acre.

Land owners who don’t farm the land productively should rent the land out to young farmers, but it has to be on long term leases to avoid taxation.

Farmers are Asset Rich and Cash Poor, but most family farmers work on the principle of, “live as if you will die tomorrow, but farm as if you will live forever”!

The tax changes do nothing for an industry that feeds the nation.

I can quite see why the farming community is upset at the new rules. As an industry, farming appears to be asset/capital rich but cash poor. Typically farming apparently produces only about a 1% return on capital – not enough easily to meet a large inheritance tax bill nor to attract people into the industry on a purely financial basis. And if, as the government says, very few farm estates will be caught by this new tax, why is it so worth the government introducing it. Equally, however, I can see that the farming exemption from IHT is becoming a loophole for billionaires to buy up farmland as a tax sheltering measure. So would an answer not be to introduce a taper relief so that full relief from IHT remains but only if the testator has owned the estate for, say, ten years. Problem solved?

Last year alone 8,100 UK farms ceased trading. Farmers have had to deal with Brexit, fuel, feed and fertiliser cost increases, the Govt’s recent NI hike and an accelerated phasing out of payments under the Basic Payment Scheme. About half of British farms are making profits of around £20k a year. And that’s before you factor in the impact of climate change. We have a situation in Britain where kids are going hungry and food producers can’t make a living…??!! It couldn’t get much worse. Or so it seemed, before the budget… There was no consultation on this and no word of the end of IHT relief in Labour’s manifesto. What opportunity did farmers have to plan for this? It’s at best deeply unfair and at worst devastating to family farming, rural communities and the UK’s food resilience. At a time when food prices are already high and global conflict and climate crises threaten food security… It will raise about 0.01% of govt spending, but at what cost nationally and locally? How will farmers invest in infrastructure or labour? It’s a clumsy, ill considered policy, and there are other consequences too…

As a wealthy faux farmer, Clarkson is a really dubious advocate for British farming, but he’s not the worst… It’s clear already that all the shabby political carpet-baggers will be making a play for the allegiances of rural communities, just as has happened on the Continent. Labour really need to rethink this – for their own chances of re-election if no other reason is compelling…. Levy CGT on those who sell farm assets, target this at the private equity funds pushing up land prices and poised to clean up as farmers liquidate assets… But don’t target family farming. Farmers are critical partners in future environmental and land management projects, and let’s not forget, they feed us…

The change announced in the Budget will not impact the majority of farmers.

• Estates worth up to £3 million could still be passed on by a couple completely free of inheritance tax.

• Where inheritance tax does apply, farmers will still pay 50% less inheritance tax than everyone else.

• Heirs can spread the payment over 10 years interest-free instead of having to pay it all at once.

The policy is about protecting smaller family farms while ensuring the wealthiest landowners pay their fair share.

Our public services need fixing and the wealthiest should be the ones who bear the greatest burden so we can do that.

Farmers will benefit from £ 5 billion being invested into farming over the next two years, the largest amount ever directed towards sustainable food production in our country’s history.

The truth about Labour’s Budget and the Family Farm Tax

• Labour promised they wouldn’t change APR.

/ APR is not a loophole. It is a specifically designed policy, maintained by governments of all parties, to prevent the break up of family farms.

• The government’s figures are incorrect. Our own analysis, working with former OBR and Treasury advisers, shows 75% of actual working farms fall above the £lm threshold, not the 27% that’s been claimed.

• Because of the price of land, farms may be worth a lot on paper, but the average farm income last year was just £45,300

for the whole family.

• Under the Family Farm Tax, a farmer’s family will often have no alternative but to sell the farm to pay the Inheritance Tax when they die.

Tenant farmers are affected. The Family Farm Tax could result in less land available to rent because landowners may choose to rent out their land for things other than farming.

Source: NFU

Paul Johnson of the IFS said “What the budget did was reduce the amount of additional relief that farmers get on agricultural land. It still means they’ll be significantly more generously treated than the rest of us and still more generously treated actually, than farms used to be in decades past”.

Where were all you farmers when Tory Boris Johnson threw away your subsidies leaving the EU? When Tory Liz Truss destroyed our economy costing farmers more for everything? You mounted demonstrations when fuel costs rose under Labour but where were you when it surpassed this under the Tories? Can anyone spot the pattern here…..?